Investopedia defines diversification1 as “a risk management technique that mixes a wide variety of investments within a portfolio,” which “contends that a portfolio of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.”

The goal of diversifying a portfolio is to “smooth out unsystematic risk events in a portfolio so that the positive performance of some investments will neutralize the negative performance of others. Therefore, the benefits of diversification will hold only if the securities in the portfolio are not perfectly correlated."

Step 1: Diversifying Your Portfolio Across Asset Classes and Categories

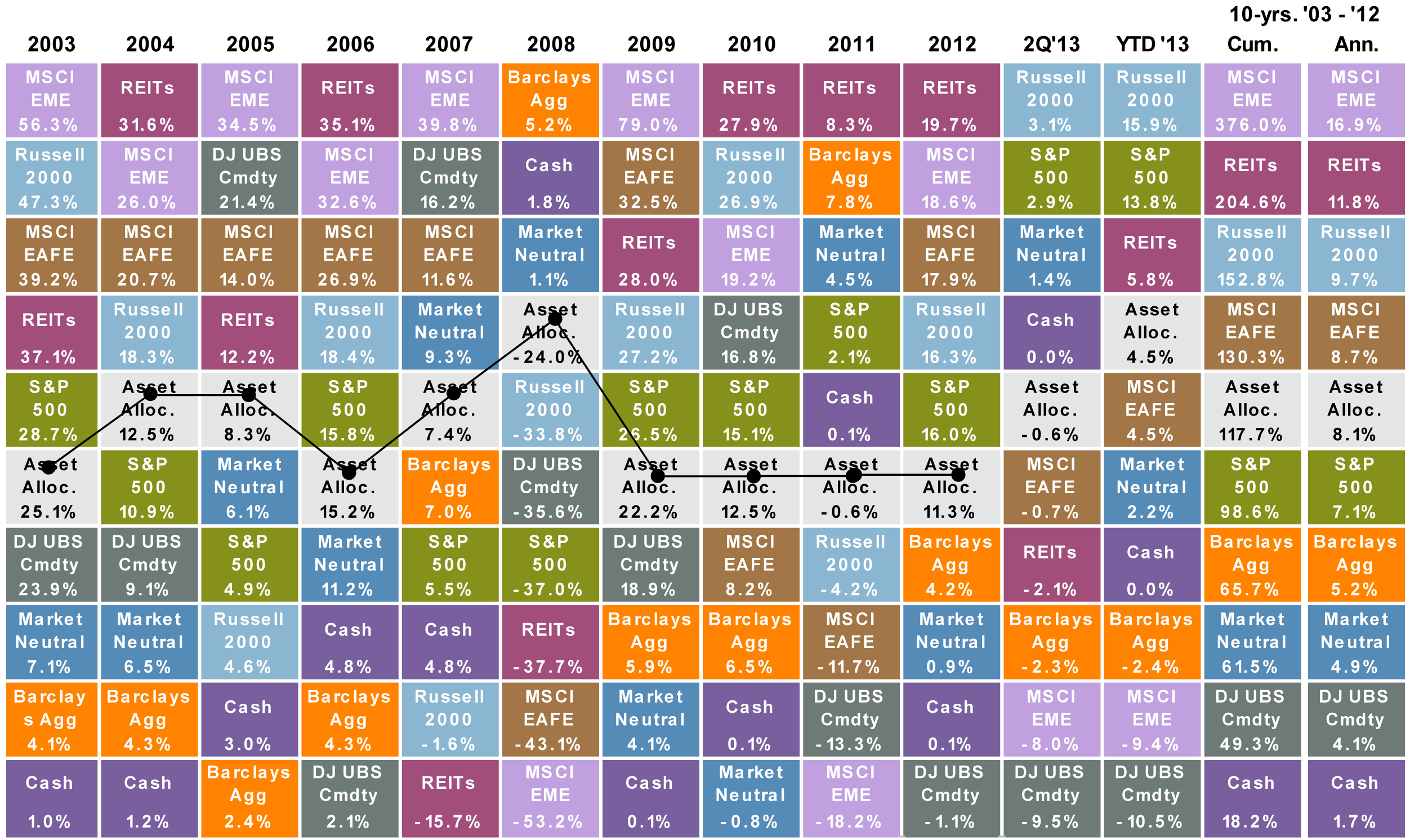

A glance at the chart below illustrates how this works. As you can see, different categories of assets may produce higher returns in some periods, but lackluster in others, and the best performing areas change hands regularly over time. (Click the chart for a larger version.)

Source: Russell, MSCI, Jones, Standard Poor's, Suisse, Capital, NAREIT, FactSet, J.P. Asset Management. The “Asset Allocation” portfolio assumes the following weights: 25% in the S&P 500, 10% in the Russell 2000, 15% in the MSCI EAFE, 5% in the MSCI EMI, 25% in the Barclays Capital Aggregate, 5% in the Barclays 1-3m Treasury, 5% in the CS/Tremont Equity Market Neutral Index, 5% in the DJ UBS Commodity Index and 5% in the NAREIT Equity REIT Index. Balanced portfolio assumes annual rebalancing. All data represents total return for stated period. Past performance is not indicative of future returns. Data are as of 6/30/13, except for the CS/Tremont Equity Market Neutral Index, which reflects data through 2/28/13. “10-yrs” returns represent period of 1/1/03 – 12/31/12 showing both cumulative (Cum.) and annualized (Ann.) over the period. Please see disclosure page at end for index definitions. *Market Neutral returns include estimates found in disclosures. Data are as of 6/30/13.2

Take 2012 for instance. The MSCI EME (emerging markets) was one of the best performers that year (+18.6%), but one of the worst listed in 2011 at (-18.2%). Selling your emerging markets exposure because it did poorly in 2011 would have hurt your portfolio in 2012, when it performed well. This is another reason it’s important not to make investment decisions based on past performance.

How Do I Diversify My Portfolio Across Asset Classes?

There are a few questions investors should ask themselves: how much do I invest in emerging markets? Do I need a fixed income allocation? What about commodities? Should I have some exposure to small cap stocks as well?

Often times, finding answers to these questions can be time-consuming and difficult. What’s more, there isn’t one right answer—it all depends on what your needs and your goals are.

As an investor’s needs change, their asset allocation will likely need to change in order to reflect their new goals. Developing a successful, long-term relationship with your Wealth Manager can help ensure your portfolio consistently evolves in lockstep with your investment plan.

At WrapManager, our Wealth Managers work to help clients evaluate their goals to hone in on what their asset allocation should be and align our recommended money manager strategies with those goals.

Part 2: Diversifying Your Portfolio Across Money Managers

Diversification doesn’t end at choosing the right asset allocation. In our view, it is equally important to make sure that each slice of your asset mix is being managed as optimally as possible. We believe that means finding great money manager strategies to focus on each slice of the pie.

Hiring the Appropriate Money Managers

Finding money managers to build out a portfolio can essentially be done in two ways:

Option 1 is to “put all your eggs in one basket” and hire one money manager who is a “jack of all trades.” Some money managers have expertise in certain fields, but we find that money managers can often be more effective focusing on a specific asset class, like emerging markets. As such, option 1 might not always be the best choice.

Option 2 is to hire a few different money managers who specialize in each category of your asset allocation — a money manager that specializes in international stocks, one for large-cap growth, another for fixed income, and so on.

As part of option 2, you can call upon the help of an outside and independent advisor, such as WrapManager, that monitors and evaluates each of the money manager strategies. If a decision is made that a particular money manager strategy needs to be removed for poor performance or deviation from its stated strategy, a replacement strategy can be recommended.

Which one would you choose?

We can help develop an asset allocation for your portfolio and recommend money manager strategies to build your portfolio. Learn more about the money managers we’re recommending now by calling one of our Wealth Managers at 1-800-541-7774.

Sources