As we get older, spending habits tend to change and some things become a bit pricier. For example, health care expenses could rise and you may decide to increase your charitable contributions instead of travelling so much. Because of these changing spending habits and price increases, inflation for several items can be higher for those over 62.1

Our advice? Plan for it! A properly designed portfolio and investment plan that accounts for rising expenses can help you plan for them before they occur. We’ll touch on how to do that below.

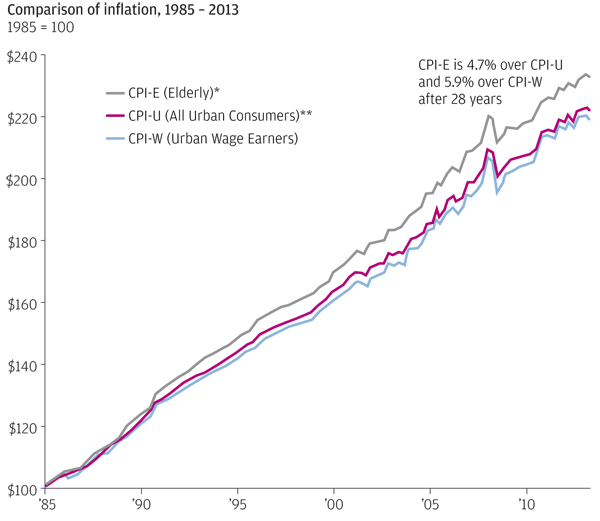

Retirees Experience Higher Inflation Relative to Other Consumers

A recent study by JP Morgan shows that since 1985, inflation has increased at a faster pace for those aged 62 and older (the grey line, CPI-E, in the chart below).

Older Individuals Experience Higher Inflation

(Click chart for larger version)

Source: JP Morgan Asset Management. *CPI-E is an experimental index from BLS that is based on elderly households with the referenced individuals at age 62 and older. **CPI-U is also referred to as Headline CPI. Source: Based on Consumer Price Indexes, BLS, J.P. Morgan Asset Management. Data as of December 31, 2013.

Because retirees’ cash flow for some living expenses tends to increase over time, it can by default reduce their purchasing power for other items – more money for healthcare can mean less money for other things.

Help Limit the Effects of Inflation with These 2 Steps

1. Create a Portfolio Designed to Outpace Inflation Over Time

With the right type of diversification, you can potentially balance the amount of risk you’re comfortable taking with the amount of portfolio growth you need in the long-term. The question ultimately becomes, what percentage of your portfolio should you hold in stocks and fixed income? And how do you choose them? A financial advisor can help.

One example of how not to do this would be by holding too much cash in your portfolio, which could prevent you from obtaining the growth you probably need over time.

2. Have an Investment Plan That Accounts for Rising Prices

When you plug your living expenses into your investment plan, make sure it takes into account how those costs can rise over time. This way your investment plan can measure the impact of rising prices on your investment portfolio, to help show if you’re on track.

Get Started on Your Investment Plan Today with WrapManager’s Help

One of our Wealth Managers can show you how rising prices over time might affect your ability to meet your retirement goals, and an investment plan can take into account changing prices of goods as well as your changing retirement income needs. Get started on your investment plan by answering a few questions here.

We can recommend what actions you should take with your investments to fight those affects. Alternatively, you can give one of our Wealth Managers a call today at 1-800-541-7774.

Leslie is a Client Service Specialist at WrapManager, Inc.

Source