On August 26, Treasury Secretary Jack Lew sent a letter to Congress warning them that the U.S. will likely reach the debt ceiling by mid-October. He noted that if Congress doesn’t raise it, the financial implications could be adverse for our economy and potentially the global financial system.1

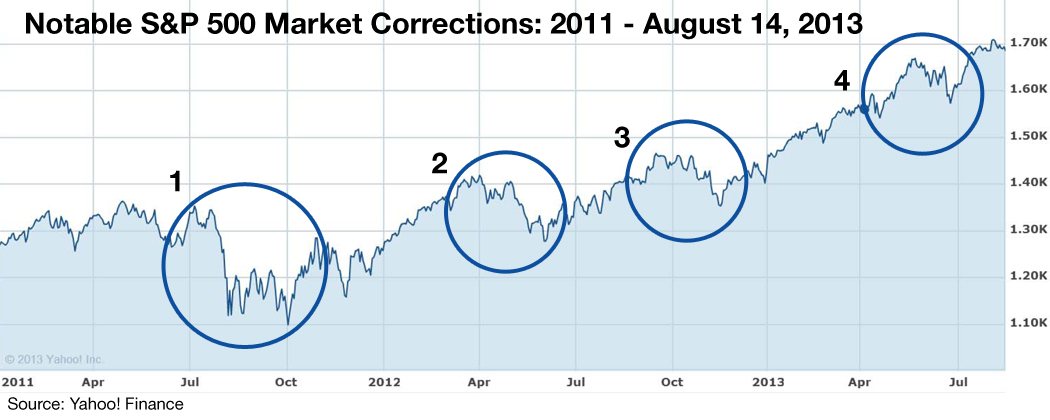

The first thought for many investors is, “here we go again.” As frustrating as these political battles might be, over the past couple of years the debt ceiling debate in Congress hasn’t had much impact on the direction of the stock market, which has been trending higher.

Will this time be different? What does the debt ceiling debate mean for your portfolio? A look at history might help us address these questions.

The Debt Ceiling Debate Has Been Going On For Over 75 Years

The debt ceiling debate is not a recent phenomenon, nor is it unique to any one political party. Since March 1962, Congress has changed the debt limit 77 times, and since the late 1950’s Congress has raised the limit every year, with the exception of fiscal year (FY) 1969 and between FY 1997 – FY 2001. More recent changes to the debt ceiling came through the Budget Control Act of 2011, under which the debt ceiling was raised on three separate occasions. The most recent change came in May of this year, when the debt limit was set at $16.669 trillion, where it stands today.2

[+] Read More