The run-up in stocks this year has been quite compelling so far. The S&P 500 is up +19.7% on the year as of August 51, and global stocks as measured by the MSCI World Index aren’t far behind at +14.34%.2

This strong performance has many investors asking: what is the probability of a stock market correction occurring sometime soon? Are there strategies to handle market corrections? Should I take some profits now as a short-term market timing strategy, so as to avoid any downside of a market correction?

In a series of posts on stock market corrections, we’ll address these questions one at a time.

What is the Probability of a Stock Market Correction Sometime Soon?

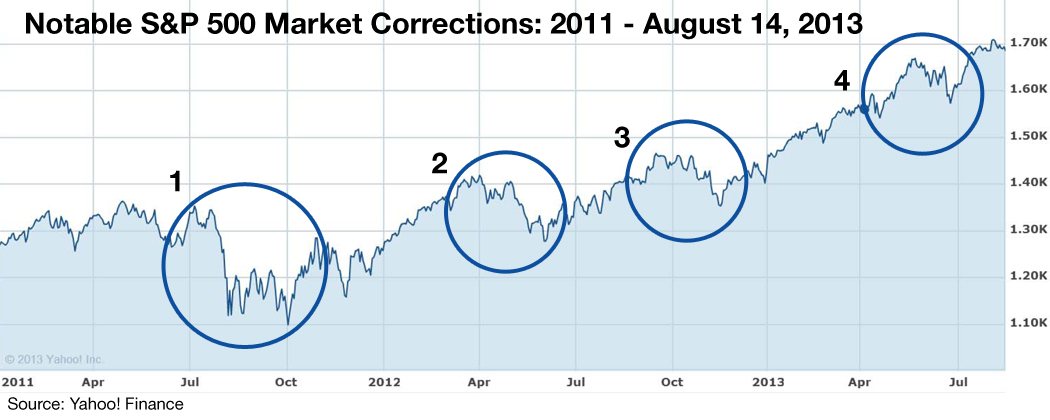

Stock market corrections are normal occurrences in the markets. In fact, over the last 33 years the average intra-year decline for the S&P 500 is -14.7%.3 Using history as a guide offers some insight into a few examples of past stock market corrections (click on the chart for a larger version):

[+] Read More