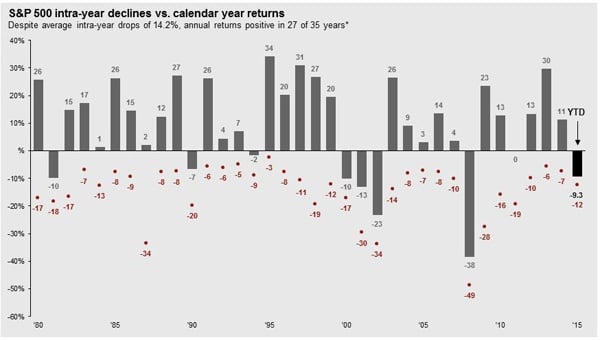

The stock market has gotten off to one its worst starts ever for a year—on last Friday alone, the S&P 500 and the Dow Jones were both down over 2%,1 and for the year the Dow has already declined over 1,400 points. Both indices are down some 8% for the year,2 and it’s still just January! Fears over China’s slowdown, cratering oil prices, and iffy corporate profits have many investors worried about what lies ahead.

In fact, a recent survey conducted by the American College showed that over 60% of retirement income specialist’s clients were concerned about the recent market volatility and their retirement security.2 Does January’s market volatility have you concerned too?

[+] Read More