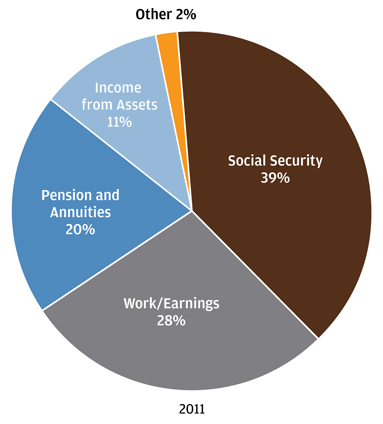

JP Morgan research shows that on average, Americans age 65 and over will get two-thirds of their retirement income from Social Security and continued work/earnings.

Surprisingly, only 11% of retirement income is expected to come from investment assets. For many high net worth investors, however, this number could be higher if they chose not to work or don’t have pensions or annuities.

In reality, your sources of retirement income differ from other investors. Give yourself a better chance of maximizing your retirement income by knowing where it’s coming from and making sure your portfolio is structured accordingly.1

Source of Income at Retirement: Average for Age 65 and Older

(Click chart for larger version)

Source: EBRI (Employee Benefit Research Institute) Databook on Employee Benefits, Chapter 7. Data as of December 31, 2011.