As we approach the end of each year, we like to take a look back at which areas of the market outperformed others. As investors, this allows us to analyze why certain areas of the market may have done better than others, and it make us think about what we can expect looking forward into the coming year.

Pulling up performance for this year-to-date (as of December 16th) shows us that US stocks as measured by the S&P 500 outperformed Europe, Asia and the Far East (EFA), and small cap stocks (IWM):

These differences in performance may lead investors to wonder…

Why Not Just Invest Everything in the S&P 500?

If your financial advisor has you invested in a diversified portfolio consisting of international holdings, fixed income, perhaps some Emerging Markets, and so on, you might be asking yourself—with the S&P outperforming these other categories, does it still make sense to be so diversified? Investments outside of the S&P 500 are seemingly just dragging down returns, right? It may be tempting to chase the asset class with the highest recent return, but as the chart below illustrates such a strategy may not deliver better returns with lower risk over time. Diversification can be a powerful and prudent tool for investors:

Just because the S&P 500 outperformed a few other categories this year does not necessarily imply it will be the best performer next year or the year after. If as an investor you shift a larger percentage of your portfolio into the S&P 500 thinking 2015 could yield the same results as 2014, you could not only increase the risk in your portfolio, you’ll also potentially miss out on having exposure to whatever the best performing asset class will be next year.The chart below underscores this point, showing how each asset class performed year over year. For example, Emerging Markets (MSCI EME in the chart), was the best performing asset class in 2005, 2007, and 2009 , with returns of 34.5%, 39.8%, and 79%, respectively. However, you don’t always get such stellar performance from investing in the Emerging Markets, as 2008, 2011, and 2013 demonstrate. In those years, it lagged almost every other category and posted negative performance of -53.2%, 18.2%, and -2.3%.

While diversification cannot not guarantee profit or protect against loss in declining markets,diversifying your portfolio across asset classes can allow you to participate in a variety of areas in the market and create less exposure to one or just a few asset classes as the market changes over time.

Looking Ahead: What to Expect for 2015

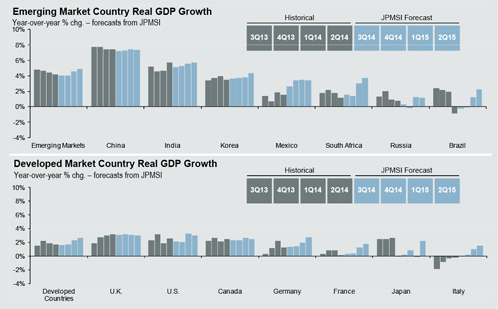

As seen below, JP Morgan sees forecasts broad-based growth across the world next year. They project emerging markets to see better growth rates next year, as well as much of the developed world on balance.2

Diversification Can Also Help Reduce Volatility

A look back at 2014 also reminds us of the role volatility can play in any given year. Reviewing the S&P 500 chart at the beginning of this post, you can see that the market took two significant dips over the course of the year, one late in July and the other at the outset of October. Such market declines can be worrisome as they occur but having your asset allocation and investment plan in place can help you stay focused on the bigger picture. As Dr. Kelly of JP Morgan puts it, “stock volatility is inevitable but is unpredictable in both magnitude and timing—that is why investors need to be diversified across asset classes.”1We couldn’t agree more.Have Our Wealth Managers Check Your Portfolio’s Diversification

The end of the year affords the opportunity to review your holdings, check performance, and make the necessary adjustments based on the market outlook and your changing goals and objectives. Our Wealth Managers are available to help you go into 2015 with confidence in your investment plan. Give us a call at 1-800-541-7774 to get started, or you can start the conversation by contacting us here.

Sources: