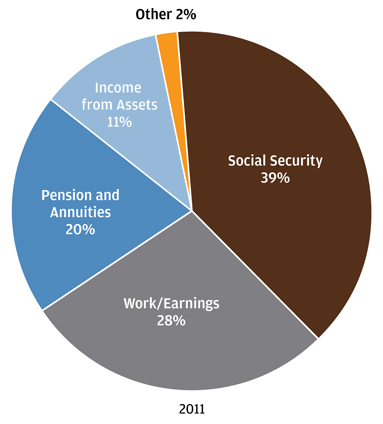

JP Morgan research shows that on average, Americans age 65 and over will get two-thirds of their retirement income from Social Security and continued work/earnings.

Surprisingly, only 11% of retirement income is expected to come from investment assets. For many high net worth investors, however, this number could be higher if they chose not to work or don’t have pensions or annuities.

In reality, your sources of retirement income differ from other investors. Give yourself a better chance of maximizing your retirement income by knowing where it’s coming from and making sure your portfolio is structured accordingly.1

Source of Income at Retirement: Average for Age 65 and Older

(Click chart for larger version)

Source: EBRI (Employee Benefit Research Institute) Databook on Employee Benefits, Chapter 7. Data as of December 31, 2011.

Maximize Your Retirement Income Sources by Knowing Them

An investment plan can help you understand and map out what your retirement income sources will be throughout retirement. The plan can also influence how your accounts and investments are structured to help make sure retirement income is there when you need it.

Depending on your goals and risk tolerance, that could mean owning fixed income securities, income-producing securities like dividend paying stocks, or perhaps selling shares of securities periodically to raise the cash needed to meet your retirement income needs.

It’s a good idea to have a balanced approach to creating retirement income streams, with the more sources of income the better. Working through this process with a financial advisor can help you establish available income streams and perhaps create some new ones you didn’t know were available.

WrapManager Can Build You an Investment Plan

The first step to seeing the benefits of an investment plan is to create one, so we’d encourage you to give one of our Wealth Managers a call at 1-800-541-7774. We can help you map out your various sources of retirement income, while also developing a strategy for creating income streams to meet your needs throughout retirement. Alternatively, you can get started now by answering a few questions here.

Sources: