The stock market overcame some volatility early in the year but continued to trend higher. As the market has reached new all-time highs, many investors are wondering if it’s too late to put additional cash to work. Others have indicated they’re still waiting for a possible stock market correction before making any decisions.

One thing remains clear – despite what happens in the market and when, it’s likely you still need your portfolio growing and generating retirement income over time.

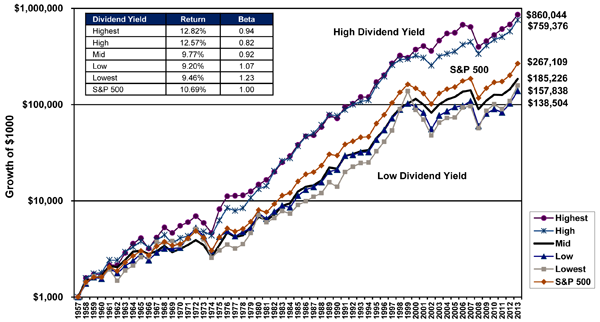

There are two types of portfolio strategies that could ease concerns about where the market’s headed while positioning your portfolio for a variety of outcomes. Tactical Strategies are designed to temper the effects of a market decline while trying to capture growth, and Dividend Income Strategies aim to generate income while reducing volatility.

Let’s take a look at both.

[+] Read More