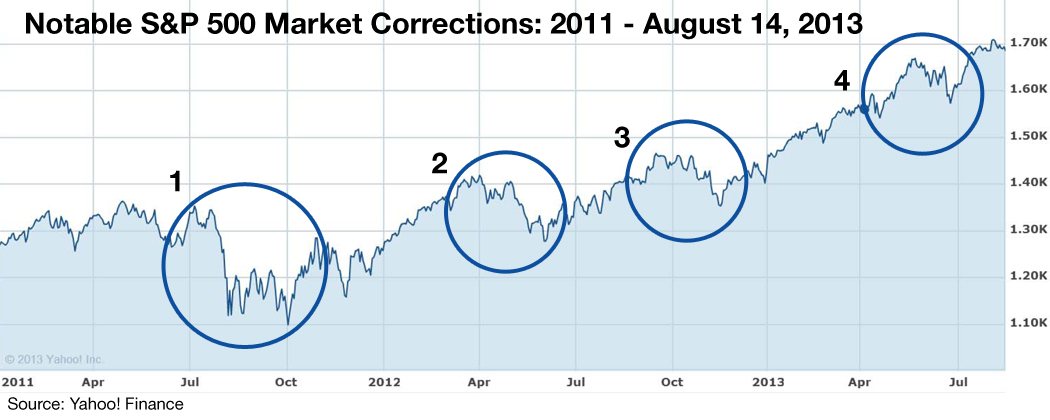

Churchill Management Group believes the odds of a stock market correction, defined by them as 10-20%, have increased. Their latest commentary explains their thinking, and addresses five news stories to expect this fall.

"The above title is an old practical adage of Wall Street that describes how markets get rattled on the rumor of events to come and tend to settle down after the news has been revealed. As we go through the maturing phase of the bull market that began four-and-a-half years ago, it is a statement to keep in mind as the news coming in September is set to be expansive and emotional. On the docket are..."

![]() Download Churchill's Full Commentary Here

Download Churchill's Full Commentary Here

Get Free Research Reports on Churchill Management