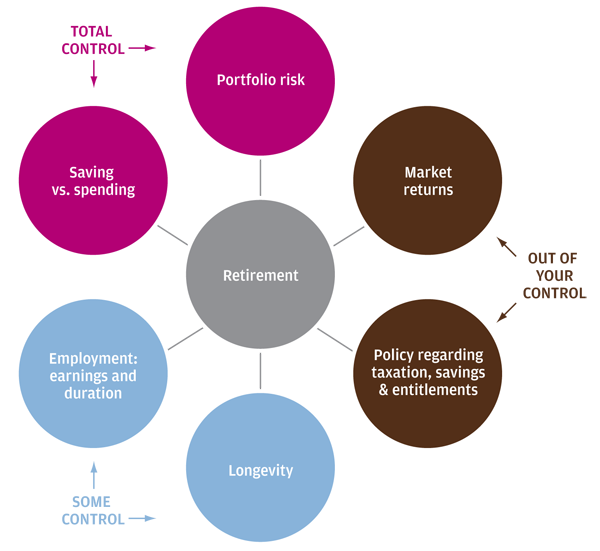

You control many of the decisions leading into retirement: how much to save, what investments to make, how long you choose to work.

But there are other factors – like market returns and policies regarding taxation, savings, and entitlements – that you can’t completely control. Or can you?

The key word here is “completely” – with the right kind of investment planning, you can regain control of some of those less predictable aspects of retirement planning.

Planning For Things You Can't Control

(Click image for larger version)

Source: The Importance of Being Earnest, J.P. Morgan Asset Management, 2013.

Controlling Market Returns in Your Portfolio

Market returns over time are unpredictable. What that doesn’t mean, however, is that you should settle for volatility or mediocrity when it comes to portfolio returns. We believe you can give yourself a better chance at achieving your desired portfolio returns over time by hiring experienced and professional money managers.

If you’re self-managing or have hired a money manager that’s not delivering results, chances are there are more effective options out there. Finding money managers can be a lot of work, and it’s a great idea to enlist the help of an independent financial advisor to sit on the same side of the table as you and help you survey as many options as possible.

An Investment Plan Can Help You Adjust to Changing Policies

An investment plan by design is meant to change with your financial needs, but it should also change if changes in tax policies or other rules, such as those associated with Social Security or estate planning, could have an impact on your investments.

Your investment plan should take into account these changes as they occur, and make adjustments as needed to ensure you don’t lose control of your assets to taxes or other factors in the process.

Take Control of Your Retirement with WrapManager’s Help

One of our Wealth Managers can sit on the same side of the table as you, to guide you into choosing money managers that fit your needs and can help you reach your goals.

By building an investment plan for you, we can help you prepare for things beyond your control and adjust your investments or accounts as needed. Give us a call today at 1-800-541-7774 to get started, or click here to answer a few questions.