You’ve probably heard it more than once in the last few months: the Federal Reserve appears likely to commence “lift-off” of interest rates at some point later this year. Some analysts believe the first rate hike could come this June, others point to September. At the end of the day, no one really knows for sure when that first hike will come (even the Fed is reluctant to commit to a defined timeframe). But there does seem to be consensus around one view: it will eventually happen.

So what does that mean for investors? Do rising interest rates spell trouble for equities and the fixed income markets? Is now the time to adjust your investment portfolio? Using history and hard data as a guide, we’ll take a closer look.

How Stocks Are Historically Affected by Rising Rates

The chart below analyzes how stocks have responded to rising rates over the last 52 years, and the basic takeaway is this: when interest rates are below 5% and rising, the stock market has tended to do well. Conversely, when interest rates are already high (5% or higher) and rising, the market has displayed more of a negative correlation.

At the time of this writing, the 10-Year US Treasury yield is at 2.32%2, which is clearly below the 5% threshold. While this certainly does not imply that entering a rising interest environment from here will have a positive correlation to stock returns, the chart analysis suggests that it is at least possible if not probable.

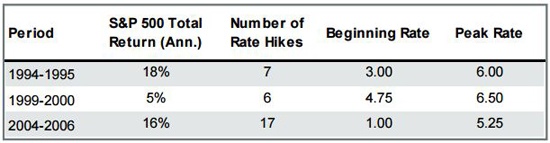

A look at some past rate hike cycles can also provide us with historical insight for how stocks were affected. Research from JP Morgan suggests that because interest rate hikes typically coincide with times of economic strength (the Fed is usually raising rates to cool the economy), there is a distinct possibility that the stock market can also do well as a reflection of the expanding economy.

JP Morgan points to three examples in history to underscore their point:

|

| Sources: Federal Reserve Board, Standard & Poor's, J.P. Morgan Asset Management. For illustrative purposes only. Data are as of 7/29/14 |

It is important to emphasize again that just because the stock market managed to deliver positive returns in previous rising rate environments, it does not automatically mean the same will happen in the future. Past returns are not indicators of future ones, and there is still the possibility that the Fed could even hold off on raising rates for some time. We believe that the global economy could see more growth for the remainder of the year, which could in turn lead to positive returns in the equities markets – in spite of what the Fed does with interest rates. Investors who have lengthy time horizons and goals of growth should talk with an advisor about what equity allocation makes the most sense for their particular situation.

How Rising Rates Affect the Fixed Income Markets

The fixed income markets tell a different story. The left side of the chart below demonstrates how the prices of fixed income securities would be impacted by a 1% rise in interest rates. As you can see, within the Treasuries category the longer the duration (30 years vs. 2 years), the steeper the price impact. The spread between alternative fixed income, like high yields and municipals for instance, is much narrower but nevertheless still negative.

The message here to investors is that if you believe interest rates are set to rise substantially from here, you may want to take a closer look at your fixed income allocation. If your bond portfolio is heavily weighted towards longer-term Treasuries, it may make sense to diversify into other categories of fixed income, or even seek alternatives such as dividend-paying stocks.

Have a Wealth Manager Review Your Portfolio Today

Rising interest rates can impact your investment portfolio, particularly if you have a significant allocation to fixed income. One of our Wealth Managers can review your portfolio holdings in detail and walk you through recommendations for structuring your portfolio relative to our market outlook and your investment objectives – at no cost to you. Give us a call today at 1-800-541-7774 or contact us here today to get started.

Sources:

1. J.P. Morgan Guide to the Markets

2. U.S. Department of the Treasury