Investopedia defines diversification1 as “a risk management technique that mixes a wide variety of investments within a portfolio,” which “contends that a portfolio of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.”

The goal of diversifying a portfolio is to “smooth out unsystematic risk events in a portfolio so that the positive performance of some investments will neutralize the negative performance of others. Therefore, the benefits of diversification will hold only if the securities in the portfolio are not perfectly correlated."

Step 1: Diversifying Your Portfolio Across Asset Classes and Categories

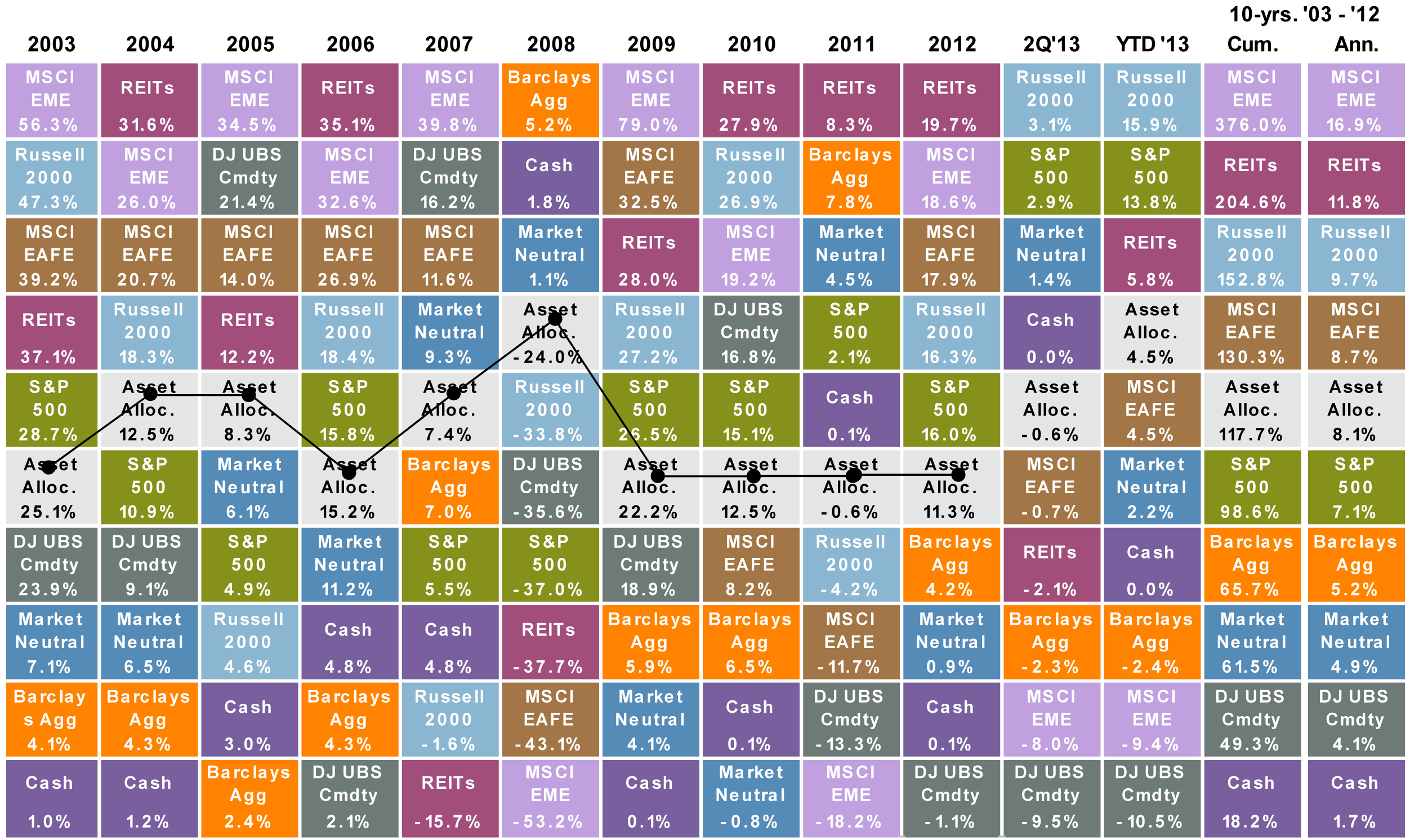

A glance at the chart below illustrates how this works. As you can see, different categories of assets may produce higher returns in some periods, but lackluster in others, and the best performing areas change hands regularly over time. (Click the chart for a larger version.)

[+] Read More