A key to investing well is finding balance between opportunities for growth and the potential risks that come with them. You want to generate returns needed to meet your long-term goals while limiting the potential portfolio risks associated with downside volatility and other adverse events.1

Practically every investor faces the following four risks to their portfolio. While each risk can be addressed in specific ways, start with good planning with your financial advisor, regular updates to your investment plan and being properly diversified. Then move on to the more specific methods below.

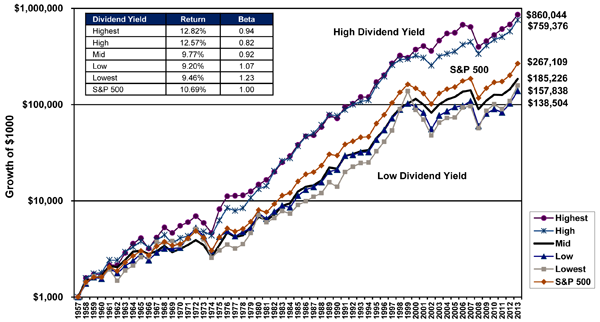

Portfolio Declines Due to Market Volatility

To paraphrase Boston money manager Newfound Research, LLC, ‘investors don’t live in a world of “100 year averages.” Instead, they live in a world of 40 year investment horizons, where significant declines can permanently impair retirement portfolios as investors do not necessarily have ‘more time’ to make up from large losses.’2

[+] Read More