March 9, 2009 marked the end of one of the worst bear markets in stock market history, and the beginning of the bull market we’re currently in. Now 5 years and +177% later,1 many investors are wondering what the future holds. Is the market now overpriced? Is the next bear market around the corner?

History can often help answer these types of questions, so we’ll take a look back at past bull markets to draw insight into the current environment.

How Long Do Bull Markets Last?

The average span of a bull market is a little under four years, but according to JP Morgan US Chief Equity Strategist Tom Lee, “averages don’t tell you anything.”1 Here’s one reason why:

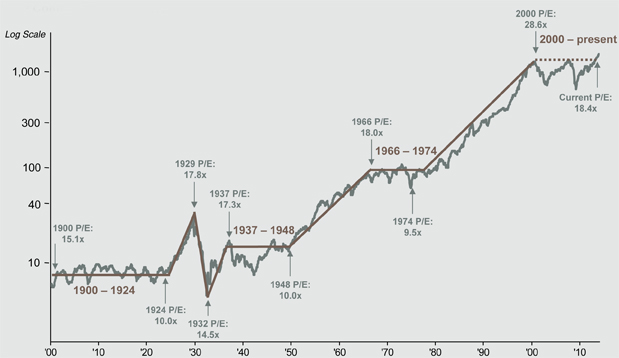

Stock Market Since 1900 (S&P 500 Composite Index)

(Click chart for larger version)

Source: Shiller, FactSet, J.P. Morgan Asset Management. Data shown in log scale to best illustrate long-term index patterns. P/E ratios shown at price peaks and troughs use trailing four quarters of reported earnings and are shown as a one year average. Past performance is not indicative of future returns. Chart is for illustrative purposes only. Guide to the Markets – U.S. Data are as of 12/31/13.