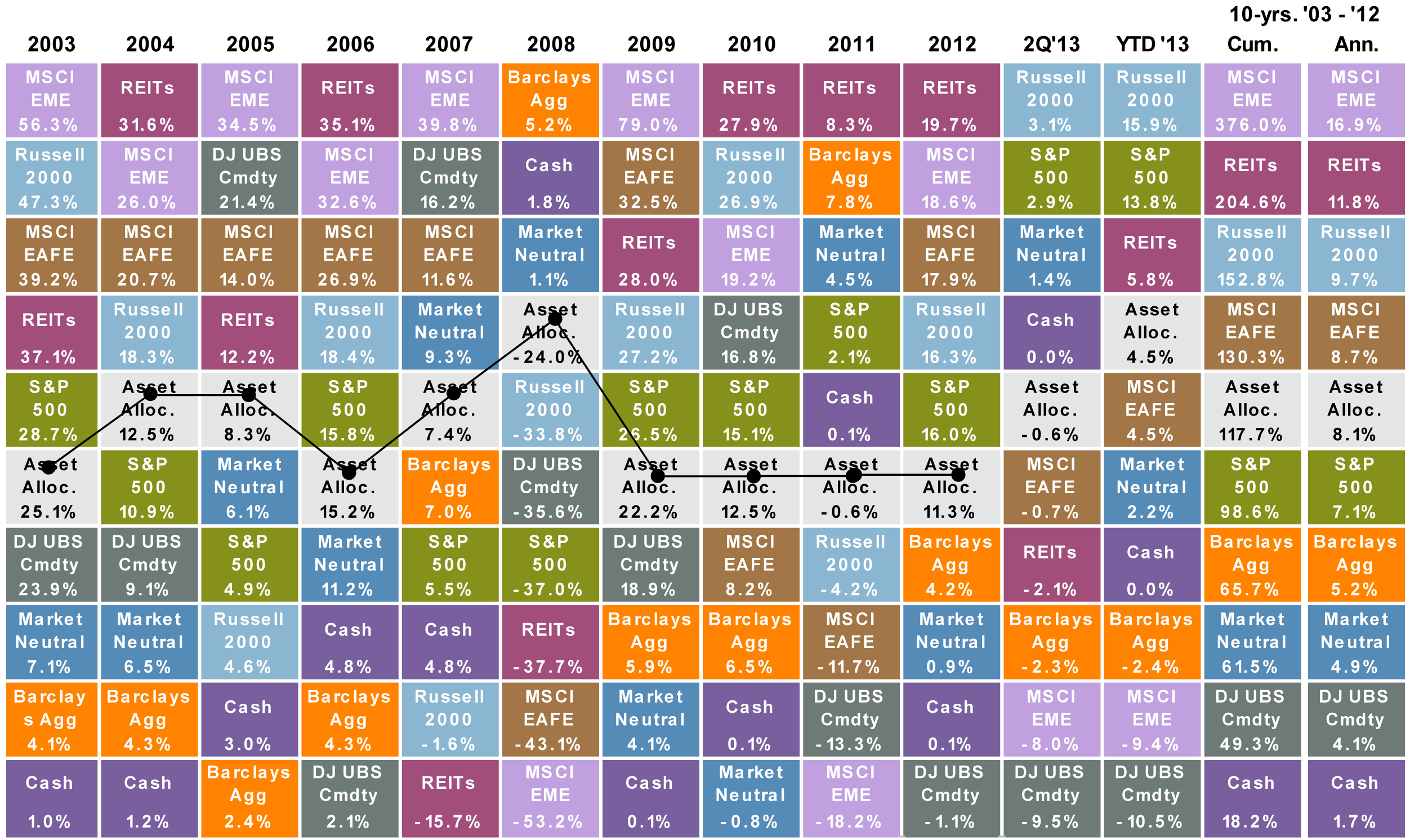

2013 is shaping up to be a strong overall year for the equity markets, and has hopefully been a positive year for many readers’ investment plans as well.

As the year draws to a close, it’s time to review a few year-end planning strategies and tips. This should serve as a basic guide to investors to review their tax situations and investment plans before year end. Our suggestions may not apply to all investors, so it’s important to consult a financial advisor and/or tax advisor before considering any adjustments.

Tax Planning Strategies to Consider

Offset Capital Gains Using a Tax-Loss Selling Strategy

Investors are able to offset capital gains with capital losses. If capital losses exceed capital gains in 2013, the excess can be used to reduce taxable income, such as wages, up to an annual limit of $3,000 ($1,500 if married but filing separately). If the total net capital loss is more than the yearly limit ($3,000), taxpayers can carry over the unused portion to the next year.1